Imagine you have a big treasure chest with coins, jewelry, and all the other things you have. And now, when you file for a divorce in Florida, you have to open it and go through all your treasures one by one. How? You need a treasure map – your Florida financial affidavit.

But how to make a treasure map?

You write down all your valuables: a house, car, savings, investments, and other precious jewels. You also add the money you receive, like salary or commission.

Next, you write what jewels you take out to pay for food, clothes, toys, and vacation.

Finally, did you promise anyone something? It also goes to your treasure chest.

Now, you have your treasure map ready.

Curious?

This post is your guide to how to prepare your Florida financial affidavit. If you do it right, you will secure your assets in divorce. And this is our goal.

But to start, more on financial affidavit meaning.

What is the Florida Financial Affidavit?

First, the Florida financial affidavit form is a comprehensive document used in family law cases in Sunshine State. It is one of the mandatory Florida divorce forms.

Second, it provides a detailed disclosure of each spouse's finances, including:

- income

- expenses

- assets

- liabilities

Think about them as four shiny coins in your treasure chest you either have or owe someone.

Third, the affidavit is a sworn to be true and notarized statement.

Next, what is the purpose of the financial affidavit?

The court needs to know the parties' financial picture to determine child support, alimony, property division, and other financial issues fairly.

You can amend your affidavit if you recall or discover new information. You might also have your financial numbers changed after filing the initial affidavit. It is normal since, after a split, both parties better understand living expenses as a single person.

When Should You File Financial Affidavit for Divorce?

You file the signed form with the Clerk of the Circuit Court in the county where you filed the petition. Remember to keep a copy of the signed affidavit for your record.

Next, you must serve a copy of the affidavit to the other party or their attorney either:

- at the initial filing

- within 45 days after the other party is served

Servicing your spouse should be either through mail, e-mail, fax, or hand-delivery on the same day as on the certificate of service.

The next question: "Are there different versions of the financial affidavit for divorce in Florida?"

Affidavit Short Form vs. Long Form

Depending on the size of your treasure chest, you will use a different treasure map.

Florida Courts use family law financial affidavit Form 12.902(b) or (c).

The Form 12.902(b) is family law financial affidavit short form pdf and for cases where the spouses' combined income is less than $50,000.

A long form--Form 12.902(c)--is a comprehensive disclosure of the entire financial situation of both parties. It may require supporting documents like bank statements, brokerage account statements, etc.

See below a comparison between Florida financial affidavit short and long forms.

Florida Financial Affidavit

Long Form

- Form 12.902(c)

- Comprehensive form

- Combined net income of both parties is over $50,000

- For cases with higher income or more complex finances

- Requires full disclosures

- May require supporting documents

- Detail inventory of all Income, expenses, assets, liabilities, real estate holdings, businesses, and personal properties

Financial Affidavit Information Gathering

Remember that our goal is to secure your assets in divorce. Right?

First, before you start working on your Florida financial affidavit, it is smart to collect and organize the necessary information. Below are examples of what you should have in your divorce file:

Second, you should organize all your data and the inventory of your assets. For example, do you have handy contact information about:

- attorney

- CPA

- financial professional

- insurance broker

- employer

- primary care physician

- health insurance company

Also, how well do you know all your accounts, insurance, real estate, and other assets?

Let's start working on your treasure map - your Florida financial affidavit.

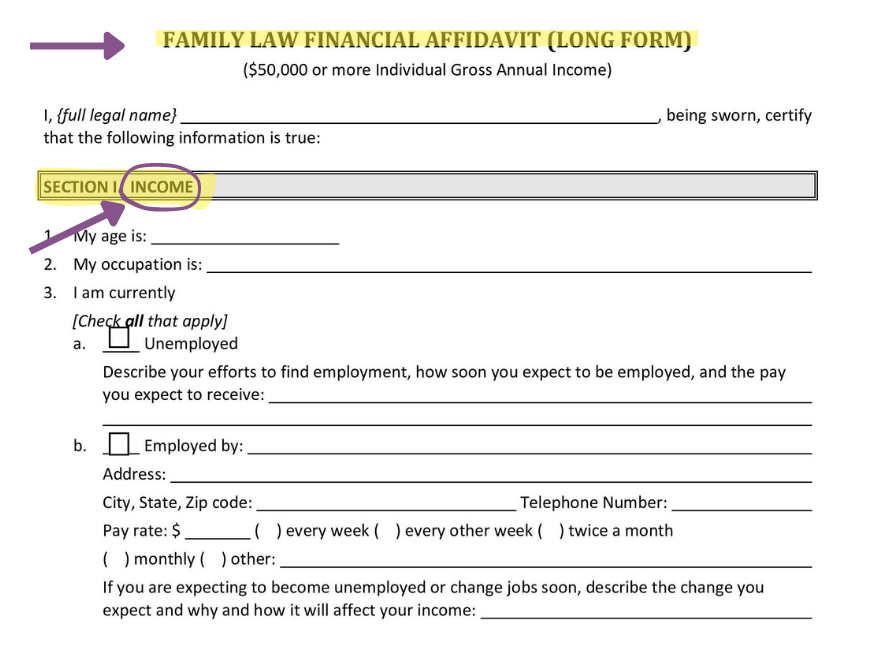

Affidavit Section 1: Income

The first shiny coin in your treasure chest is your income. Respectfully, you will find the detailed income description in Section 1 of the Florida financial affidavit.

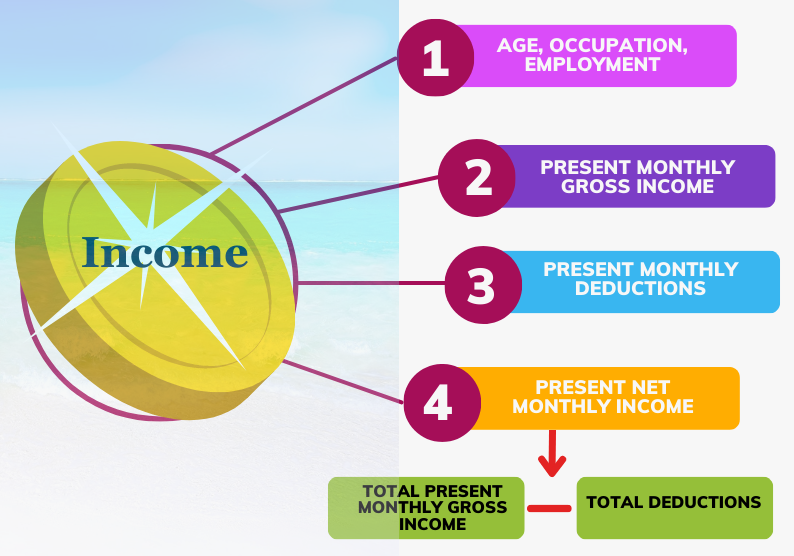

INCOME SECTION has three subsections and asks about the following:

1. Age, Occupation, Employment, Retirement

This part is self-explanatory. If you write additional information, be brief and to the point.

2. present monthly gross income

All amounts should be MONTHLY. They include:

3. Present monthly deductions

All amount must be MONTHLY and cover the following deductions:

The final number of the Income section is PRESENT NET INCOME (you subtract total deductions from total present gross income).

PRO TIP: Enter gross income as it is shown on a pay stub before any deductions. Typically, this would be a larger number than would be shown on a W-2.

Common Mistakes When Completing Affidavit Income Section

Want to avoid mistakes and possible delays?

Mistakes in your Florida financial affidavit can cost you! Remember that our goal is to secure your assets in divorce.

Recently, a couple--Paula and Mike--called me as a CDFA® (Certified Divorce Financial Analyst®) to review their affidavit. I found numerous common errors, made all adjustments, and prepared a revised version.

Let's go through some of those pitfalls.

1. Not Providing Accurate Information

Remember garbage in, garbage out?

That's why you should be very precise. Paula needed to be more organized and have all the records. Again, you must have your information ready and have copies of all your statements and documents.

2. Not Calculating Properly Monthly Income

Paula told me she was paid twice a month (24 times a year). However, her pay stubs showed that the checks were 14 days apart. It was clear that she actually got paid bi-weekly or 26 times per year.

3. Not Knowing the Number of Paychecks

In addition, Paula forgot that, in reality, she received 19 paychecks for a year. As a result, I reduced Paula's monthly income by $330. It would not be good if she showed that she made more money.

PRO TIP: If you adjust the number of your paychecks, you should recalculate your monthly income, deductions, and Net Monthly Income.

4. Double-Counting

Next, Paula included her health insurance payments as a deduction. She also had the same numbers later as an "expense" in Section 2. As a result, she deducted those dollars twice, which is double-counting and prohibited.

5. Not Including All Incomes

Next, Paula cashed her company stock for whopping $90,000 but didn't add proceeds to her income. After a review, I knew money couldn't mysteriously appear from a thin year.

So be sure to provide information about your income from all sources like employment, self-employment, rental properties, investments, and any other sources of money you receive.

And now, let's look at a coin in your treasure chest when you pay for things.

Affidavit Section 2: Expenses

Section 2 in the Florida financial affidavit is EXPENSES. Here, you put proposed/estimated expenses under different categories, and it is very straightforward:

- Household

- Automobile

- Expenses for children common to both parties

- Expenses for children from another relationship

- Other expenses

- Payments to Creditors

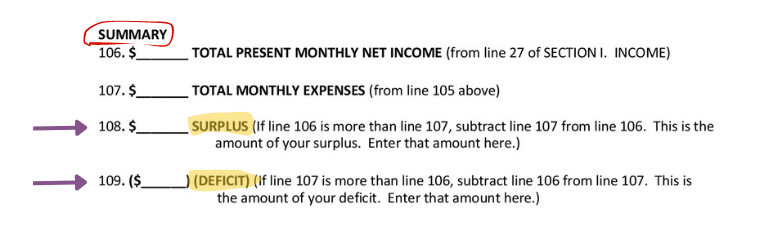

- Summary

In Summary, you deduct TOTAL MONTHLY EXPENSES from TOTAL MONTHLY NET INCOME. As a result, you either have a SURPLUS or DEFICIT. View Summary as your Monthly Budget.

If you don't see a type of expense on the list, add it to "Other." Go through all your statements, and don't skip any entry.

PRO TIP: If your health insurance is paid as payroll deductions, enter payroll deductions in Section 1 and out-of-pocket deductions (expense) in Section II.

On line 65, "Life Insurance," enter the accumulated cash value in the policy if you have so-called "permanent" insurance. This is NOT the death benefit or face value.

Remember that only "whole life" type policies have cash value. For term policies, this entry will always be ZERO.

Also, be sure that you convert quarterly or annual expenses into monthly. Remember that in Florida's financial affidavit, you should use monthly income and expense amounts.

Next, if the household expenses don't reflect what you actually pay currently, write "estimate" next to each estimated amount.

Your information will likely be your best guess if you don't have access to your family's budget and bank statements.

PRO TIP: For your record, assign your expenses as either "fixed" or "variable." Fixed is when your bill stays the same, and it is mandatory--mortgage, rent, electricity. Variable expense is at your discretion and can vary. It will help you to make potential adjustments to your lifestyle.

But wait! There is more...

Affidavit Section 3: Assets and Liabilities

Well, it is more...

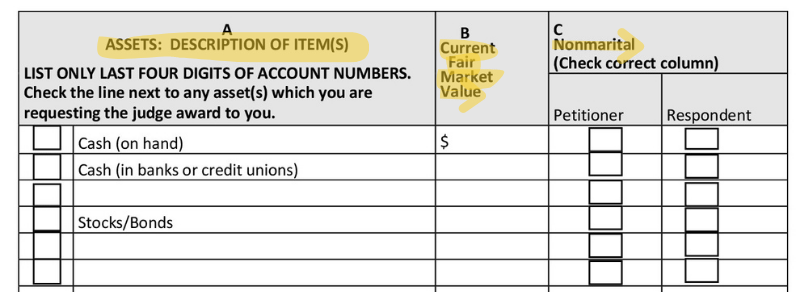

Section 3 of the Florida financial affidavit--ASEETS and LIABILITIES--is the largest coin in your treasure chest. It has five sub-sections:

A. Assets

Here, you identify and value everything you own:

For each sub-section, the form shows three columns:

- A - Description of items

- B - Current Fair Market Value

- C - Nonmarital

To complete the form, follow the steps below:

Column A

List a SHORT description of each item owned by you. Blank spaces if you need to list more items.

Column A

Check the line next to any item you request the judge to award to you, or you are responsible for.

Column B

Write what is the current fair market value of all items listed.

Column C

Check a box only if you believe an item is a non-marital property.

PRO TIP: For an asset, you might want to enter the value as of a specific valuation date.

B. Liabilities

Here, you list the debts you are responsible for:

Please follow the same steps as above.

- a marital debt of $2,000, and

- a separate debt of $1,000

What else is left?

Get a FREE Consultation with us Today!

Affidavit: How Much Are You Worth?

Net Worth and Declaration

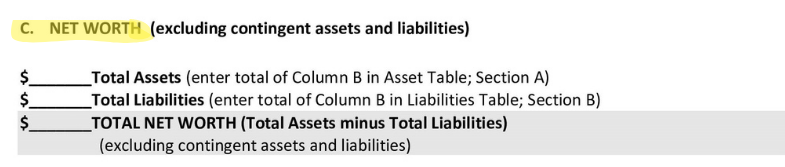

Now, it is time to answer the question, "How much are you worth?"

To do it, you subtract your total liabilities from your total assets. In other words, it is your NET WORTH.

Be sure to include all assets and debts in calculating your net worth (except contingent assets and liabilities). Otherwise, you will show a lower or higher number than it is in reality. In turn, it may cause a red flag and delay your case.

And the FINAL step in preparing your Florida financial affidavit is to SIGN and SWEAR that you read the document and the facts stated in it are true. You declare this under penalties of perjury.

Also, before signing, you CERTIFY that you delivered a copy of your affidavit to the other party or their attorney on a specific date using the following:

- fax

- hand delivery

You have finished your treasure map - your Florida financial affidavit.

And now, are there any questions you have?

Pre-Divorce Checklist PDF: 7 Sure Steps for Better Divorce

Frequently Asked Questions

FAQs

Yes. Especially you should get help if you have more complex finances:

- few real estate properties

- rental properties

- business interest

- executive compensation like stock options or restrictive stock units

- an investment portfolio with a nonmarital portion

Other than legal assistance, the best person to help you with an affidavit is a CDFA® (Certified Divorce Financial Analyst®). They are not only a money expert but specifically trained on matters of divorce and money.

You can amend your affidavit if you recall or discover new information. You might also have your financial numbers changed after filing the initial affidavit. It is normal since, after a split, both parties better understand living expenses as a single person.

Yes. The Florida financial affidavit Form 12.902(c) has "Instructions for Florida Family Law Rules of Procedure." It answers when you should use the form, what steps you should take, important information regarding e-filing, and offers other special notes.

Next, each affidavit section has separate instructions on completing the form and calculating net totals.

Also, you can check the self-service center at your county clerk's office. Of course, bookmark this post and use it as a reference.

Remember that the financial affidavit is one of the mandatory Florida divorce forms for legal proceedings and can greatly impact your case. If you provide false information, it can lead to:

1. LEGAL PENALTIES. Lying on the financial affidavit might be perjury or fraud, which is illegal.

2. NEGATIVE IMPACT ON YOUR CASE. The courts use financial affidavits to decide on divorce issues like child support, alimony, and property division. Discovering that you gave false information can significantly damage your credibility and jeopardize the court's decision.

Final Thoughts...

Remember our goal?

It is to secure assets in a divorce. How can you do it?

By accurately preparing and correctly filing your Florida financial affidavit.

Remember that it is not just about numbers and figures. The affidavit also tells your true and honest financial story.

Further, it can help others--your spouse, attorney, and a judge--understand your financial situation. As a result, the Courts make fair decisions that can greatly impact your life and the lives of your loved ones.

Can you afford to mess it up?

In summary:

- Gather all your records and organize financial information;

- Get a copy and review the Florida financial affidavit;

- Read all instructions carefully;

- Complete each section and be sure your figures are accurate;

- Don't use round numbers;

- Sign the document and certify that you delivered a copy of the affidavit to the other party or their attorney;

- Amend the affidavit if you make a mistake or uncover new information

If you have questions about the Florida financial affidavit, ask the attorney or contact us, your CDFA®. And remember that in a divorce, YOU ONLY HAVE ONE CHANCE TO GET IT RIGHT!

What Are You Waiting For?

Start Controlling Your Money!

Looking out for you,

Nella Zelensky

About the Author