Let me guess: you and your spouse divide 401k in a divorce, and you think that divorce and 401k are complicated...

You are thinking: "How is a 401K split in a divorce? Do I get half of my husband's 401k in a divorce? Who pays taxes on a 401k that is split in a divorce?"

There are many questions and even more "what ifs."

Of course, you might panic because you don't want to make mistakes. After all, a 401k plan can be your largest asset after a marital home.

And here I came in. I will take some confusing topics of divorce and 401k plans and break them down into everyday language. Also, I will show you how to avoid the top 3 tax mistakes using real-life case studies.

Let's dive in and start with divorce and 401k basics.Divorce and 401k Plans Basics

It is imperative to know that divorce and splitting 401k assets might differ from state to state.

Community Property vs. Equitable Distribution

There are two types of property division statutes: community property and equitable distribution.

In a community property state, everything is "community property" and is most likely subject to a 50/50 split.

So, if you are asking, "Do I get half of my husband's 401k in a divorce?" The answer is "yes" if you are in a community property state.

Exceptions are:

- Separate property before the marriage

- Gifts or inheritance

Equitable distribution states use the principle of "fair and equitable" distribution, which doesn't necessarily mean 50/50.

What else should you consider?

401k Plans: Marital vs. Non-Marital Portion

What is the difference between marital and separate property in divorce and 401k plan?

Generally, if you or your spouse didn't contribute to a 401k plan before the marriage, the total balance is a marital asset and is to be divided.

However, if you or your spouse contributed to a plan before tying a knot and can prove it(!), that portion is so-called a "separate" property and not subject to a division. In this case, you might need a valuation of the account, which can be a simple calculation.

But!

A pre-divorce portion of the 401k plan can significantly impact earnings. A specially trained professional like a CDFA® (Certified Divorce Financial Analyst®) can help you with Separate and Marital Property Tracing and Valuation.

Book FREE 30-Minutes Strategy Session!

Get Separate and Marital Property Tracing STRESS-FREE

Vested vs. Non-Vested Balances of 401k Retirement Assets

Next, you probably know that "vested" is the amount that belongs to you. Here, it is irrelevant if you remain employed, retire, or quit.

Conversely, non-vested money can be forfeited if you leave your company before it is fully vested.

In some states, only the vested portion of a 401k plan is subject to a division during a divorce. In other states, a non-vested amount can also be marital property.

KEY TAKEAWAY: You should know if you live in a community property or equitable distribution state. 401(k) can be either marital property or a combination of marital and separate portions. For contributions before marriage, the burden of proof is on you.

Taxes on a Division of 401k in a Divorce

And now, a big elephant in the room: paying taxes on the income from splitting a 401k in a divorce.

Generally, you will pay ordinary income tax on a distribution from a qualified plan. But here, there are a few ifs.

IRC Section 72(t) Divorce and 401k Plans Exception

Do you know the earliest age to access money in a defined contribution plan without penalty?

That's right. It's 59 ½.

However, there are some exceptions:

- Death and disability

- Medical expenses

- Qualified higher education

- Annuity payments for the life expectancy of a person

- Divorce

Yes, when you get divorced and are under 59 ½ years old, you receive your portion of your spouse's 401k money 10% penalty-free. This exception is under IRC section 72(t).

Good to know, right? Keep reading. There is much to a story.

Direct Transfer vs. Rollover

Next, you probably heard phrases like "direct transfer" and "rollover."

The difference?

If you transfer money from a qualified plan to an IRA, a check is sent directly from the 401k plan to the IRA. You never touch the money, and it is a direct transfer.

In a rollover, on the other hand, the plan sends money to you first, and then you put funds into the IRA.

As a result, in the eyes of the IRS, your payment is taxable and subject to a mandatory 20% withholding. We will illustrate it later.

Sometimes, a direct transfer refers also to a trustee-to-trustee transfer or a direct rollover.

You might ask: "Is there any specific protocol to transfer 401k money without tax consequences?"

Yes!

All qualified retirement plans are divisible in a divorce by a QDRO (Qualified Domestic Relationship Order). It is a complex document, and the subject of QDRO is beyond the scope of this post.

Divorced Gals now offers flat-fee pension valuation and QDRO facilitation services. We would be happy to answer any questions regarding plan terms, election options, or survivor benefits. Learn more about our services.

KEY TAKEAWAY: In divorce and 401k plan, if you are under 59 ½, payment from your spouse's qualified plan is 10% penalty-free (IRC section 72(t). You should also know the difference between rolling over and transferring money from a qualified plan.

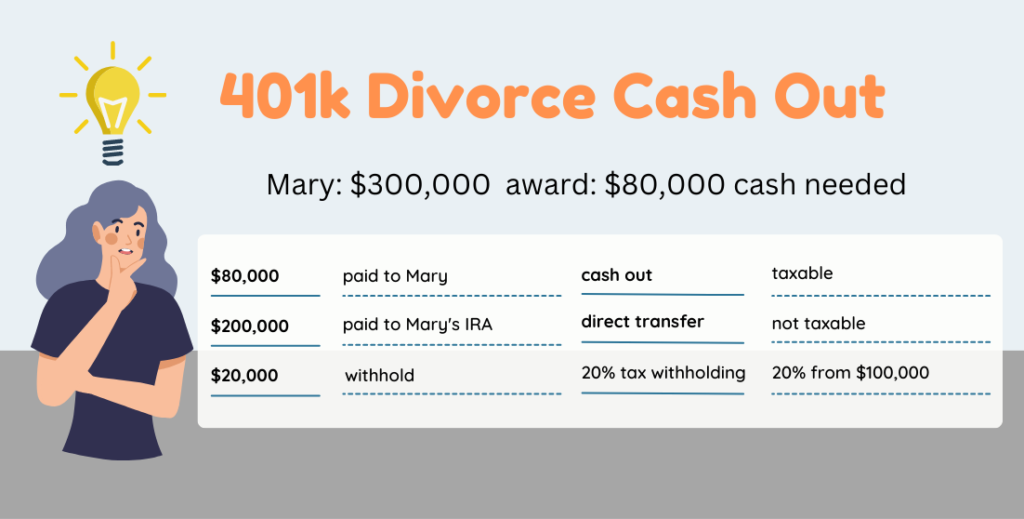

Case Study #1: 401k Direct Transfer and IRA Cash Out in a Divorce

Let's illustrate how divorce and splitting 401k plan works. We will also review where you can easily make mistakes and how to avoid them.

Mary is 54 years old and just divorced her husband. According to a divorce settlement, she got $300,000 from her husband's $600,000 401k plan.

What are Mary's options?

Cashing Out After a Transfer

(penalty and ordinary income tax)

- The 401k plan directly transfers money to Mary's qualified plan or an IRA.

- Mary needs money after a transfer and cash out the funds.

Under IRS rules, it is an early withdrawal, so Mary will be paying:

- ordinary income tax

- 10% penalty

By the way, remember that an IRA is not a qualified plan. Of course, some qualified expenses allow you to get money from the IRA penalty-free, but it is a separate topic.

KEY TAKEAWAY: If you don't need money and the plan allows immediate distribution of 401k funds to a former spouse, use a direct transfer, which is non-taxable.

Case Study #2: Divorce - Should You Cash Out 401k?

What if Mary needs cash before a transfer to an IRA?

Let's assume $25,000 to pay her attorney and $55,000 for house renovations.

Of course, you might ask, "How about Mary's savings or other cash resources?"

You are correct. Using retirement money before retirement should be the last resort!

But let's continue with our example.

So, Mary needs $80,000 cash. Does she remember the 20% mandatory withholding? For this, Mary has to request $100,000. As a result, $300,000 breaks down like this:

- $80,000 will be paid directly to Mary (cash out) - taxable

- $200,000 goes to Mary's IRA (direct transfer) – not taxable

- $20,000 represents 20% withholding tax (calculated as 20% from $100,000)

The divorce and 401k example above has a more subtle potential problem.

We don't know Mary's effective tax bracket. Right? Therefore, $20,000 in taxes may be too much or too little to cover Mary's tax liability.

If it is too little, Mary should pay a difference when tax time comes. However, if it is too much, Mary might take unnecessary tax liability!

Another concern is that Mary cannot put money back into her IRA.

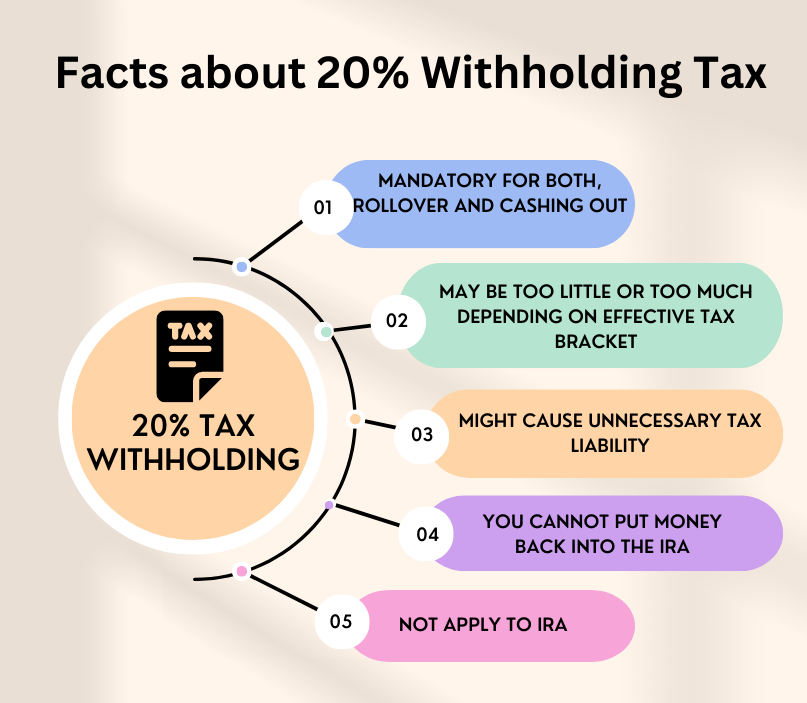

What else should you know about 20% tax withholding?

Let's use an example of rollover.

KEY TAKEAWAY: A retirement plan should be the last resort for cash. But you can either order money sent directly from a qualified plan to you or withdraw funds from the IRA. Always remember 20% tax withholding (not apply to IRAs). Under 59 ½, IRA "qualified expenses" will avoid a 10% penalty.

Case Study #3: Divorce and 401k Rollover

Another scenario.

Assume that after a divorce and 401k assets split, Mary receives her ex-husband Paul's $100,000 401k.

She didn't want his mutual funds in her account, so she requested money sent to her.

Then, she rolled over money into different mutual funds of her choice. Of course, since the check was made directly to her, the rollover is subject to a 20% withholding tax.

So, Mary deposited in her IRA $80,000.

Next, the $20,000 withheld is considered a withdrawal and subject to tax.

Can Mary do something to avoid it?

Yes!

She could have added $20,000 of her own money, but unfortunately, she did not have extra cash. It's a pity since the IRS would have probably refunded that amount to her after filing her taxes.

Further, let's assume that Mary is in the 33% tax bracket between federal and state taxes. Here, she will pay an extra $6,600 in taxes.

Of course, when it was time to file her tax return, $20,000 in taxes was already paid.

Another issue Mary has:

- Effect of having an extra $20,000 growing tax-deferred

Now you see how it is critical to consult your financial professional or tax advisor before distributing 401k plan money.

Contact Divorced Gals and talk to Nella Zelensky, a CDFA® (Certified Divorce Financial Analyst®).

KEY TAKEAWAY: When making a lump sum payment through QDRO, it is critical to notify the plan administrator if it is to be transferred in whole or in part to the former spouse's IRA. This will help avoid 20% income tax withholding.

And now on to the FAQ…

FAQ: 401k Split During a Divorce

Yes.

If the plan administrator allows it, you can leave money in the plan. When you retire, you will start taking a distribution. It is logical, especially if you are under 59 ½ and don't need money. However, you must start taking money at age 73 for the required minimum distribution or RMD.

You should consult your attorney before using any marital assets for a divorce, including a retirement plan.

There are options if you want to keep as much of your 401k money as possible. Here, it would be best if you consider different facts:

- How close are you to the Social Security age

- Is it an option to sell your home

- Make lifestyle changes and put more money back into your 401k

Keep in mind that divorce settlement is all about negotiation. Therefore, you might offer your spouse another asset instead of your 401k money. Of course, $100,000 from a 401k plan does not equal $100,000 in the money market. And the reason is taxation.

Again, consult your CPA or financial professional like a Certified Divorce Financial Analyst® (CDFA®).

It is illegal to hide any assets during a divorce. Please know that as a part of divorce proceedings, you must submit a Financial Affidavit. This "sworn" statement shows your income, expenses, assets, and liabilities. Lying on the Financial Affidavit in most states is perjury. End of story.

If you cash out your 401k plan before divorce with the intent to show less money, you still will be responsible for the full amount which is a "marital asset" (in most states). Furthermore, you can be accused of "wasting marital assets" if the proceeds don't benefit both spouses.

Also, "hiding" money this way is easily discoverable since you will be preparing your sworn Financial Affidavit and supplying all supporting documents and statements.

Additionally, cashing out your 401k can be very expensive. Consider the following:

- ordinary income tax

- 20% tax withholding

- 10% early withdrawal penalty (if you are under 59 1/2)

- losing creditor protection

- loosing potential tax-advantaged growth

Of course, there is so-called "hardship distribution" for medical, funeral, and some other specific expenses when a 10% penalty is not applied.

It is not only about having a divorce settlement. It depends on when a QDRO (Qualified Domestic Relationship Order) was filed. QDRO is a complex and mandatory document for dividing qualified retirement plans.

The correct question to ask is "What is the valuation date of the 401k plan?"

If your state considers the value of the plan as a marital asset till the day of the divorce, it makes sense to put your contribution on hold and not to grow your spouse's portion on your dime.

If, on the other hand, your 401k contribution and earnings are "yours" (separate property) and not marital property after the date of separation, there is no need to stop contributing.

Word of Wisdom: remember that when you stop your 401k contribution, you also don't receive your company matching contribution which is "free" money plus potential tax-advantaged growth.

Quiz: 401k Retirement Accounts in Divorce

Final Thoughts...

I hope I did justice to the main idea of divorce and 401k and that you are no longer confused.

Let's summarize.

First, there are three potential tax mistakes when dividing 401k plan in a divorce:

MISTAKE #1: Not considering mandatory 20% withholding tax applied to both a rollover or cashing out.

MISTAKE #2: Not considering a 10% penalty (for those under 59½) and ordinary income tax when cashing out after a transfer from 401k to an IRA.

MISTAKE #3: Potential unnecessary tax liability.

Now you know what to do. Go back to each divorce and 401k case study and see what is best for you.

Second, I hope that you take the next step and find out everything you can about your and your spouse's 401(k):

- Do I know where my 401(k) money is?

- What is my current vested balance?

- What are the rules in my state if there is a non-vested portion?

- Did I start my 401k before marriage, and if yes, do I have statements from back then?

- Have I ever taken a loan from my 401(k)?

- What are the rules about divorce distribution options and 401k?

- Where is all my enrollment paperwork?

Yes, it's a complex process to understand all you need to know about your divorce and 401k assets. Yes, some of the issues can be daunting. And, yes, there is still a lot for you to learn.

But you are not alone, and you're on your way, which is a critical part of your divorce process.

And when you get your most beneficial divorce settlement, it will all be worth it.

For Divorce and 401k, Know Your Options.

Contact Divorced Gals today!

Last word of wisdom: when dealing with divorce and 401k plan, be involved and know your options. After all, it's YOUR money!

We would love to hear from you.

Nella Zelensky

About the Author, Nella Zelensky, CDFA®, MAFF®

Faced with her divorce, Nella realized she knew nothing about divorce and money, and even though she was from the financial industry, she made a few costly mistakes. Then, she decided to become a Certified Divorce Financial Analyst® (CDFA®) and, later, a Master Analyst in Financial Forensics® (MAFF®). Nella's mission today is to help other women going through a divorce navigate the financial chaos and confusion so they can avoid money pitfalls and feel confident and happy again.