Are you lost in a divorce financial maze? A Certified Divorce Financial Analyst (CDFA®) can guide you through it, help you avoid costly mistakes, and secure your post-divorce financial future.

Meet Lora, a 45-year-old who had been married for 20 years and had three kids. Because of irreconcilable differences, she decided to get a divorce.

The couple was always good with money: they bought a marital home, built a family business, and saved for retirement and a rainy day. That's why Lora was very optimistic about her future.

But!

Lora faced a harsh reality. First, she needed to learn the complex financial intricacies of a divorce. And second, her husband used aggressive tactics to secure a larger share of the marital assets.

What did she do?

Frustrated, she contacted me, a CDFA®, for help and guidance. She knew it could be instrumental in making informed financial decisions for a more secure post-divorce future. And that's what we will discuss in this post.

But first, what is a Certified Divorce Financial Analyst?

What is a Certified Divorce Financial Analyst®?

Financial Expert in the Divorce Process

To start, if you decide to split, I bet you have tons of looming questions:

A CDFA® is a professional who can answer all those questions. They are skilled at analyzing financial data and are your go-to financial expert in divorce.

The CDFA® goal is to help you gain financially equitable settlement and advise on the following:

- Marital vs. Non-Marital Property

- Dividing a Marital Home and Other Real Estate

- Real Cost of Divorce

- Valuation and Division of Assets

- Retirement Plans and Pensions

- Executive Compensation Division

- Divorce Tax Issues and Solutions

- Expert Witness Testimony

- Creative Divorce Financial Planning for Primary Bread Winner

- Short and Long-term Financial Impacts of Different Settlements Proposals

Click here for more information about CDFA services.

CDFA® vs. CPA and Financial Planner

Next, a Certified Divorce Financial Analyst® has a financial planning, accounting, or legal background. They undergo intensive training to become skilled at advising on the financial issues of divorce.

But you might wonder how a Certified Divorce Financial Analyst® is different compared to other financial experts.

CDFA® is a blend of two approaches: accounting and financial planning. See below a comparison table:

CDFA® and Other Experts Professional Role

Looks at the details of the scenario as it is today and makes no future projections. In divorce, they perform:

Helps people achieve financial goals regardless of a divorce or happy marriage. They focus on financial results in the future based on certain assumptions made today to see if the client is on track to meet their stated goals and objections.

It blends two approaches: a CPA and a financial planner. CDFA helps the client and their attorney to understand how today's financial decisions in a divorce will impact the client's financial future based on specific assumptions.

CDFA® as a Reality Agent

Lastly, divorce puts people under tremendous stress about their financial well-being. And much of that stress is because of fear of the unknown.

That is why you should keep yourself in the reality of your financial situation before, during, or after a divorce. A Certified Divorce Financial Analyst® is your REALITY AGENT. They help you to understand your financial situation and feel in control of your life.

Interested?

Who Should Use a CDFA®?

While anyone going through a divorce can benefit from the expertise of a CDFA professional, there are two conditions:

- You should afford the services of a CDFA®

- Your finances should be complex enough

CDFA Client Profile

Most CDFA clients have been married for over 10 years, have an average net worth of over $500,000 and an annual income of over $150,000.

Additionally, the majority of CDFA clients have different financial backgrounds, specifically:

- one primary wage earner

- two equally contributing wage earners

- retired couples

- one retired/one still working

It is important to note that those individuals entered the marriage under different circumstances:

- first marriage or previous marriage

- children, step-children, or no children

- significant assets or no assets

- inheritance or potential inheritance

Of course, most high-net-worth individuals going through divorce employ the services of Certified Divorce Financial Analyst®.

How Much Does a CDFA Cost?

First, it can be either a rate per hour like other professionals, a flat fee, or a combination of both, depending on the scope of engagement.

You and your attorney can engage a Certified Divorce Financial Analyst® to prepare the complete divorce financial plan or work on a specific assignment. Check our divorce services A La Carte.

Second, the hourly fee varies from state to state and county to county, ranging from $200 and up.

Who charges more?

Overall, the CDFAs with more experience and narrow expertise have higher fees, especially if they do forensic work. Also, litigation support and deposition assistance might trigger higher costs.

But who governs the activity of CDFAs?

IDFA: Institute for Divorce Financial Analysts

First, remember that divorce proceedings are different state by state. Therefore, each CDFA should be familiar with their specific state's rules and divorce statutes.

Additionally, some professionals might practice in more than one state or nationwide, depending on the type of engagement.

Second, the activity of Certified Divorce Financial Analysts is under the governance of The Institute for Divorce Financial Analysts (IDFA®). It is a premier national organization dedicated to the certification, education, and promotion of CDFAs in the divorce arena.

Certification

The IDFA established stringent professional standards and requirements for CDFA candidates:

- Experience

- Education

- Examination

- Ethics

Those high standards communicate to the public that CDFA professionals adhere to a high level of the Code of Ethics and Professional Responsibility. You can rest assured that IDFA members follow the established practice norms and a specific process.

Divorce Financial Planning Process

Even though the scope of divorce financial engagement can vary, a CDFA professional uses the following 5-step process:

Step 1.

Establish and define the relationship with a client:

- Agreement about the scope of service

- Fee Agreement

- Disclose any limitations or conflicts of interest

Step 2.

Gather client data:

- Obtain quantitative and qualitative information and documents

Step 3.

Completion of analysis:

- Use unbiased judgment and sound economic principles when developing a financial opinion

Step 4.

Presentation and delivery of the assignment

Step 5.

Completion of engagement

- Send a letter to a client to confirm the completion of the engagement

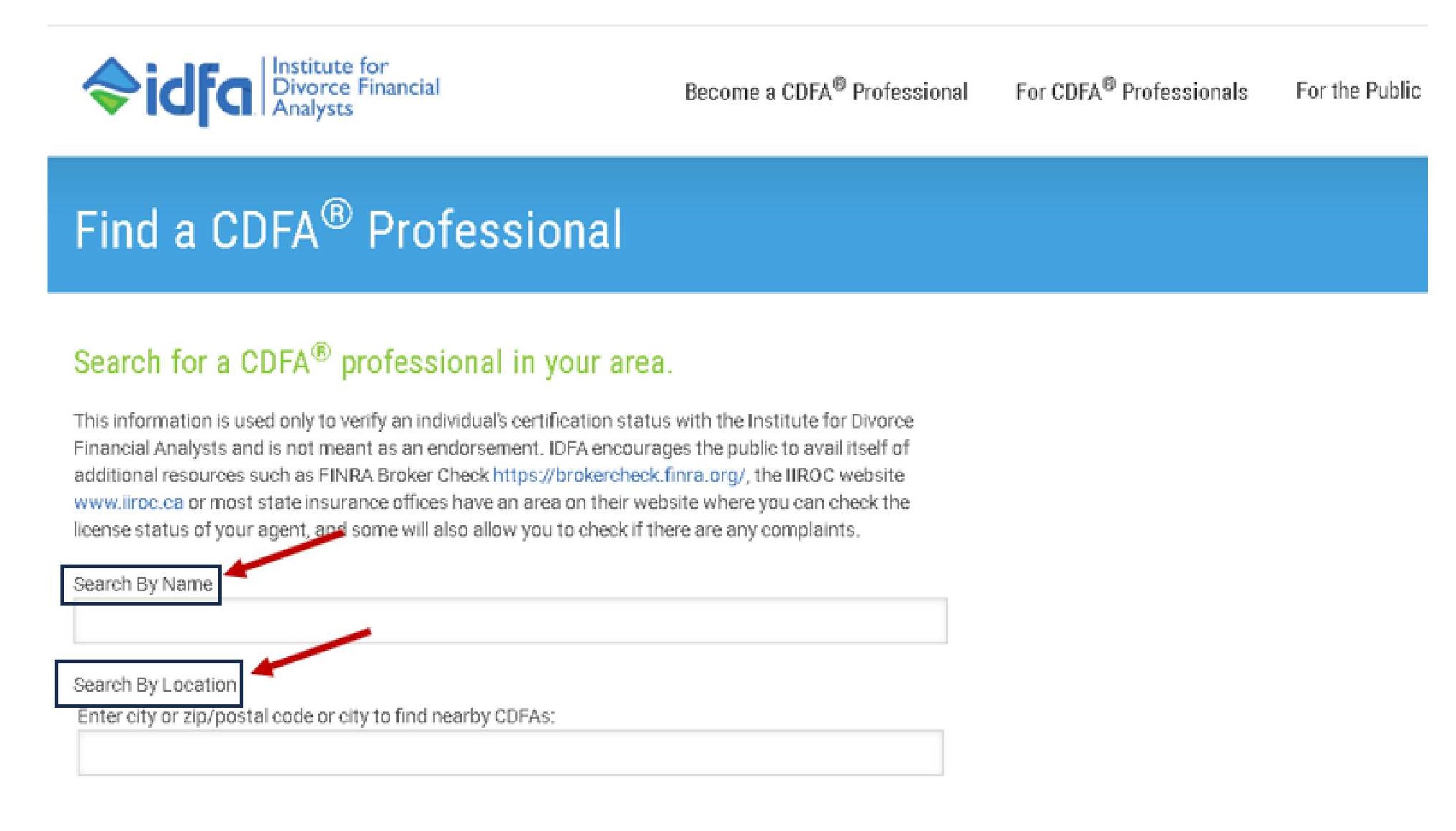

How to Find a Certified Divorce Financial Analyst

The IDFA has an extensive directory of all its members where you can find their profile and contact information. For this, take the following steps:

- Go to www.institutedfa.com;

- On the second menu, choose the tab "For the Public" and click "Find a CDFA Professional" in a dropdown window.

- You can search for a CDFA® by name or by location/zip code

- Click "Search" and scroll down for a complete list.

PRO TIP: Try to choose a CDFA® with a dedicated divorce practice and a website, not just a part of their wealth management or brokerage services.

But wait!

Before you take the next step in your divorce, check my CDFA® profile and go through our Pre-Divorce Checklist: 7 Sure Steps for Better Divorce.

Final Thoughts...

Remember Lora?

When we met, she reached rock bottom, worrying sick about numerous divorce issues:

Little by little, I helped Lora move from financial chaos to clarity and make powerful, informed choices. Next, we reached a more equitable settlement, saving her time, money, and a lot of frustration.

Result?

Lora is happy, excited about her financial future, and regained strength and confidence. And this is the power of working with a Certified Divorce Financial Analyst®.

Remember: while emotions run high and uncertainty looms, a CDFA® can guide you through your divorce financial maze.

Could you afford not to have one?

What Are You Waiting For?

Start CONTROLLING Your Money!

Looking out for you,

Nella Zelensky

About the Author, Nella Zelensky, CDFA®