"I AM RUNNING OUT OF MONEY!..." You've lost your alimony payments and are panicking, feeling fear, or even hysteria. Well, do you have alimony insurance?

For 17 years, I have helped women ease their financial burden during and after a divorce. I've heard many stories, and the most heartbreaking is when an ex-spouse dies or becomes disabled, especially if there are children.

The common problem here is a lack of essential divorce and insurance planning.

Result?

Economic hardship and colossal stress. Please don't risk it!

In this post, you will learn powerful lessons on why to have an alimony insurance policy and how to do it correctly.

Curious?

Alimony Insurance and Why My Neighbor Lost Her Hair

First, let me tell you the story of my neighbor Sarah and how she lost her beautiful hair.

I met Sarah and her husband, Mike, five years ago. She was a pretty woman in her early 40s with gorgeous red hair. Life was beautiful for Sarah: beach-front house, two kids in private school, Mike's successful career, and happy marriage. Or, so she thought.

One day, Sarah found out about Mike's infidelity. Going through emotional turmoil, she filed for a divorce. Fortunately, Sarah got a nice settlement.

Two years later, Sarah got terrible news: "You've got cancer."

Soon after, Mike got in an accident and passed away. Her spousal support stopped, but luckily, an alimony insurance policy was a part of the agreement.

Remember Sarah's beautiful hair?

She was terrified to lose it because of chemo. She heard about the cold caps, a protocol to prevent hair loss. At that time, it was $600 a session out of pocket, but Sarah was confident everything would be fine.

A few days after scheduling chemo, she got a call from the insurance company telling her that the alimony insurance policy had lapsed.

Imagine!

Sadly, there are many women like Sarah. Some lost their home and moved to a smaller place or relocated. Others said goodbye to a private school for a child or, like Sarah, stopped special medical treatment.

Particularly hard is the loss of alimony for older women.

As for Sarah, she is okay now since I helped her to start generating income.

What's the morale of the story?

To start, let's ask the question, "What the heck is alimony insurance?"

What is Alimony Insurance Policy?

You are not alone if you need clarification about insurance, especially divorce and insurance. And it is no wonder it might sometimes trigger sour emotions. But before you judge, I encourage you to learn more, at least the following basics.

Alimony Insurance Basics

Life or disability Insurance

Alimony insurance is essentially life or disability insurance. The insured here is an ex-spouse who pays spousal support.

End of alimony payments

You already know that when your spouse dies, the alimony payments stop. That's why you need a tool like life insurance to secure alimony and replace your ex-spouse's income.

Alimony Insurance by Court Order

Courts in many states can order life insurance to protect child support or alimony.

Why do courts do this?

Remember the goal of spousal support?

It is to ensure a person's marital lifestyle after a divorce. So, you should view alimony insurance as a security blanket for spousal support.

Another point is to minimize the impact of a divorce on children. As stated by family law attorney Jennifer Weisberg Millner in The National Law Review, "...life insurance is needed in order to make sure a parent has sufficient support for a child if child support is ended due to the other parent's death."

Is there an alternative to alimony insurance?

Yes. I will cover it in a later chapter.

The next logical question is, "What should you know about insurance in divorce vs. marriage?"

KEY TAKEAWAY: If you don't plan and your ex-spouse dies, you can lose the alimony payments since the settlement obligation terminates upon the death. Having life and disability insurance is a safe way to secure alimony.

Lesson 1: Avoid Common Insurance Mistakes

First, here are some common insurance mistakes you should avoid.

1. Not Having Any Insurance During Marriage

According to the World Street Journal, only 52% of U.S. adults today have life insurance. Are you one of them?

If you don't have any insurance, it can be very costly. Having insurance protects your ability to get insurance or so-called "insurability." Remember that you can only get insurance if you are healthy.

Further, if you have inexpensive term insurance during a marriage, you can convert it to a permanent policy later.

2. Not Having Enough Insurance

Married couples who do carry some life insurance, often don't have enough.

Why?

Same reason: lack of planning which is critical for your financial freedom. Also, insurance planning is essential for your overall divorce process.

Financial freedom is available to those who learn about it and work for it".

-Robert kiyosaki

What should you know?

First, you get insurance through group coverage at work, but consider the following:

- Generally, group coverage is around $50,000 unless an employee is an executive.

- It ends when the ex-spouse's employment ends.

- The insurance companies can change terms in the event of a merger or acquisition.

- The ex-spouse employee can designate a new beneficiary without notifying the support recipient.

Second, if it is private insurance and you got it a while ago - when did you last review it?

Your family has grown, you bought a house, make more money, but you still have the same insurance coverage. Well, how often do you usually upgrade your phone?

You got my point.

Use an insurance calculator to see if you have enough coverage.

Check if you have enough protection!

3. Not Adjusting Insurance Needs at Separation

Next, what is the difference between life insurance in marriage vs. alimony insurance?

The reality is that when you are getting a divorce, insurance becomes more significant for a spouse receiving child and/or spousal support (the "support recipient").

Jennifer Millner--a family law attorney-- suggests that calculating the proper amount of coverage can be one of several issues in divorce and insurance.

Also, remember that this obligation is only for a specified time, and it is state-specific.

Of course, if parents choose to, they can continue with life insurance for much longer. But it’s only possible if there is still good communication between ex-spouses. But what if it is a bitter divorce or, God forbid, a blood bath?

KEY TAKEAWAY: When divorcing, identify any existing insurance plans and update your life and disability policies. Know your state-specific rules about alimony payments.

Get our Information Worksheet to inventory your insurance policies and other assets.

Lesson 2: Know in Advance Issues with Alimony Insurance

Next, you should know that getting alimony insurance can be tedious.

Physical and medical records

Your ex-spouse should agree to take a physical. They meet a medical professional who takes a person's blood, urine, vitals, and sometimes ECG. All these depend on many personal factors:

- Age

- Health condition

- Medical history

- Amount of insurance

Also, your ex-spouse should ask their physician to release medical records to an insurance company.

Insurance Cost

Next, how much does insurance cost?

It is especially critical if you are getting a new policy at your current age. It is a significant consideration since you will likely need it for many years.

But what is the price of peace of mind?

Also, as The National Law Review stated, the age and health of the insured person in a divorce should be a consideration. If, for example, there are some health issues, insurance premiums can be high and therefore be a burden for one party.

For sure, it might not be an "equitable" solution.

Agreement between spouses

Both ex-spouses have to agree to have the alimony policy or modify an existing one. Is your spouse a reasonable person?

If you agree, the insurance amount should be a part of the annual budget. In turn, it will be a factor in how courts decide on alimony amounts.

Pre-existing conditions

Of course, your ex can get coverage only if they have no major health problems. But what if not?

First, you must apply for insurance before the divorce is final; otherwise, using for coverage after a divorce can be too late.

Second, if the ex-spouse is uninsured, there are other alternatives:

- The court can order a payor spouse to establish a trust fund instead of life insurance.

- The deceased spouse's estate might be liable for the remaining amount of alimony. But be sure there is money there.

- You can have guaranteed payments through an immediate annuity. Here, an issue is having a lump sum of cash ahead of time.

KEY TAKEAWAY: While divorcing, be aware of alimony insurance issues and be prepared.

But wait! There is more...

Lesson 3: How to Structure Insurance in Divorce

Even if your spouse is insured, you should know how to structure a policy to avoid major mistakes.

Remember Sarah?

Why did she lose alimony insurance?

Sarah was receiving her monthly alimony stated in a divorce decree. The court ordered her husband Mike to carry life insurance payable to Sarah, and the term would be as long as Sarah received alimony.

About a year after the divorce, Mike decided to stop payments, so the life insurance lapsed. Of course, Sarah didn’t know about it until he died.

The loss of alimony insurance had a devastating financial impact.

Yes, Mike was in contempt of court. But it was too late to do anything. And even if Sarah sued his estate, there were not enough assets to make up for the life insurance.

How to prevent this problem?

The safest divorce and insurance strategy is for former spouses to own life insurance policies on each other. Or at least you, as a recipient spouse, should hold the life insurance policy on your ex. This way, nobody can make changes without your knowledge.

Another way to avoid Sarah’s problem is to make her an irrevocable beneficiary. In this case, if Mike stops paying, she will be notified before the insurance lapses.

In acrimonious cases, it is advisable to have children as beneficiaries, but it is beyond the scope of this article. For more information and a detailed insurance review, contact us today!

KEY TAKEAWAY: If you receive alimony payments, you should either be the insurance owner or an irrevocable beneficiary.

Alimony Insurance FAQ

I am sure you still have some questions. Let’s address some of them.

Yes, if it is permanent insurance with a cash value and the spouse paid a premium during a marriage. You can:

- Cash it out and split the proceeds according to the settlement.

- Leave it intact and exchange a portion of the non-insured spouse for some other asset.

The division of proceeds from a cash-value policy is state-specific.

Is term insurance ever considered a marital asset?

Yes, in some states, if the insured has since become uninsurable. In this case, term insurance could be considered a marital asset.

Suppose the court ordered one spouse to purchase insurance for spousal support, and the ex-spouse owns the policy. In that case, those premium payments are treated like spousal support, or alimony, for tax purposes.

It depends!

When insurance payment is a part of alimony, taxation follows changes after the Tax Cuts and Jobs Act of 2017 (TCJA). In divorces dated January 1, 2019, or later, it’s NOT tax-deductible by the person paying the alimony. And if you are receiving support, you do NOT report those payments as income.

In pre-2019 divorces, premium payments are spousal support for tax purposes and CAN be deductible. Ex-spouses receiving alimony should declare them as taxable income.

If you start collecting insurance, it is tax-free income, no matter the date of divorce.

A beneficiary designation is how property can pass from person to person. An example is life insurance or retirement accounts. In life insurance, a divorcing spouse can change beneficiary anytime (except if it is irrevocable). But most spouses don’t have it as a priority.

You usually update beneficiary designation after a divorce, but it depends on state statutes. Some states, for example, can revoke a divorced spouse as a beneficiary. Result? You will not be able to collect.

Advise: talk to your attorney first to change beneficiary during a divorce.

Overall, it is “no,” according to state laws. But! The divorce decree can override those rules. So, pay attention to specific language in your agreement.

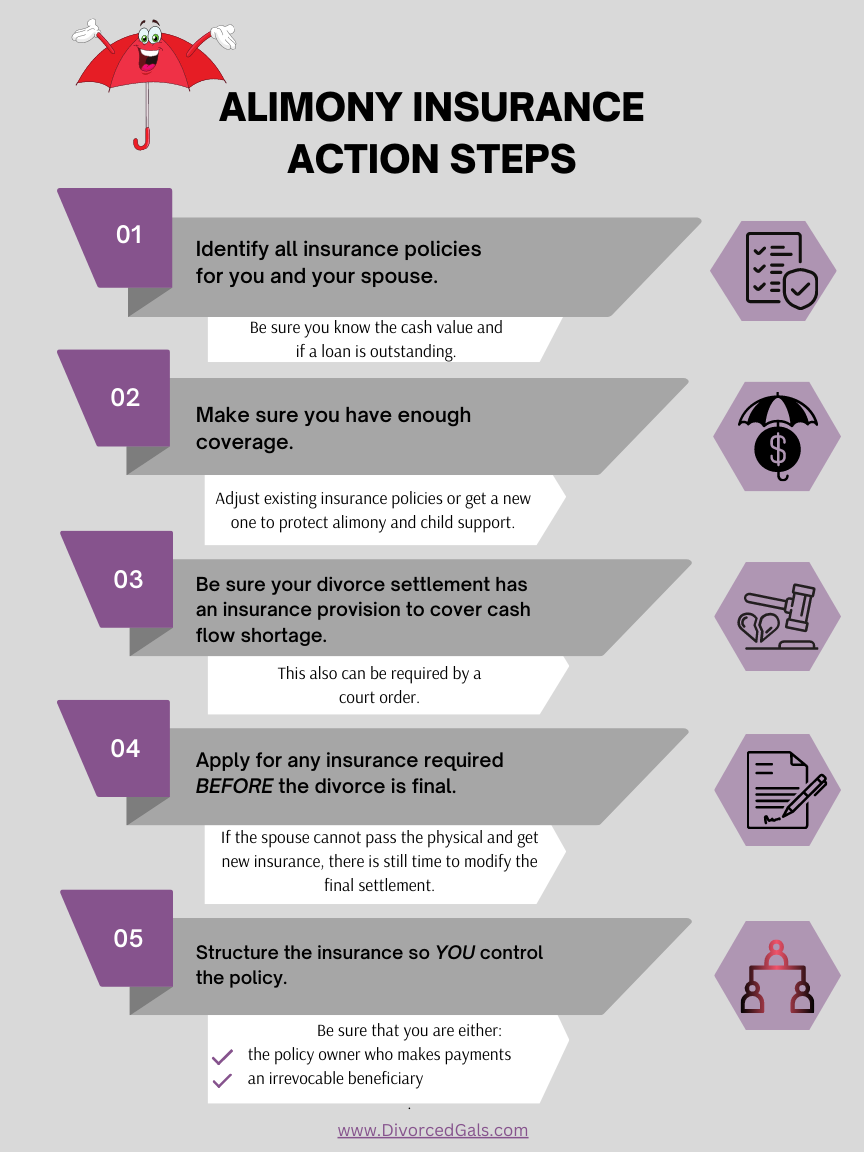

In Summary: Alimony Insurance Action Steps

I hope you are no longer confused about alimony insurance and divorce.

In summary, review below your ACTION STEPS:

Again, alimony insurance is about securing spousal or child support with life and disability insurance.

Also critical are the beneficiary and the owner of the life insurance. If you are a policy owner, negotiate extra child or spousal support to cover the premiums. This way, you will control policies and know they are in force.

Remember that even if the court requires your ex to have insurance, a lapsed policy can leave you highly vulnerable.

Here at Divorced Gals, we aim to help you get a financially responsible divorce and a better settlement. As a result, you will feel confident, calm, and in control.

So, are you ready to learn more about alimony insurance?

Barry Giske