You are happily married, and with your spouse, you are sailing through life, basking in the glow of love. But beneath the tranquil surface lies a lurking danger, and one day, you find yourself in treacherous waters of financial infidelity.

What happened?

You accidentally discovered a bank statement with your spouse's name on it that you had no clue about. Will you think of betrayal? Would it rack your boat? Would it ruin your marriage?

Yes, today's topic is that sneaky little devil who can wreak havoc on your happy marriage and your hard-earned cash. But don't worry!

This post will equip you with the knowledge, tools, and even a sprinkle of humor to sail through this storm and emerge stronger on the other side.

Ready?

What Is Financial Infidelity?

First, let's have an understanding of financial infidelity in couple relationships.

Remember, when people get married, most of them combine finances. Therefore, when handling money, they promise transparency and cooperation.

Unfortunately, it doesn't always work this way. As a result, a spouse might deceive you by hiding money, inheritance, assets, receipts, bills, or other evidence of their financial misbehavior.

And here, you are not alone.

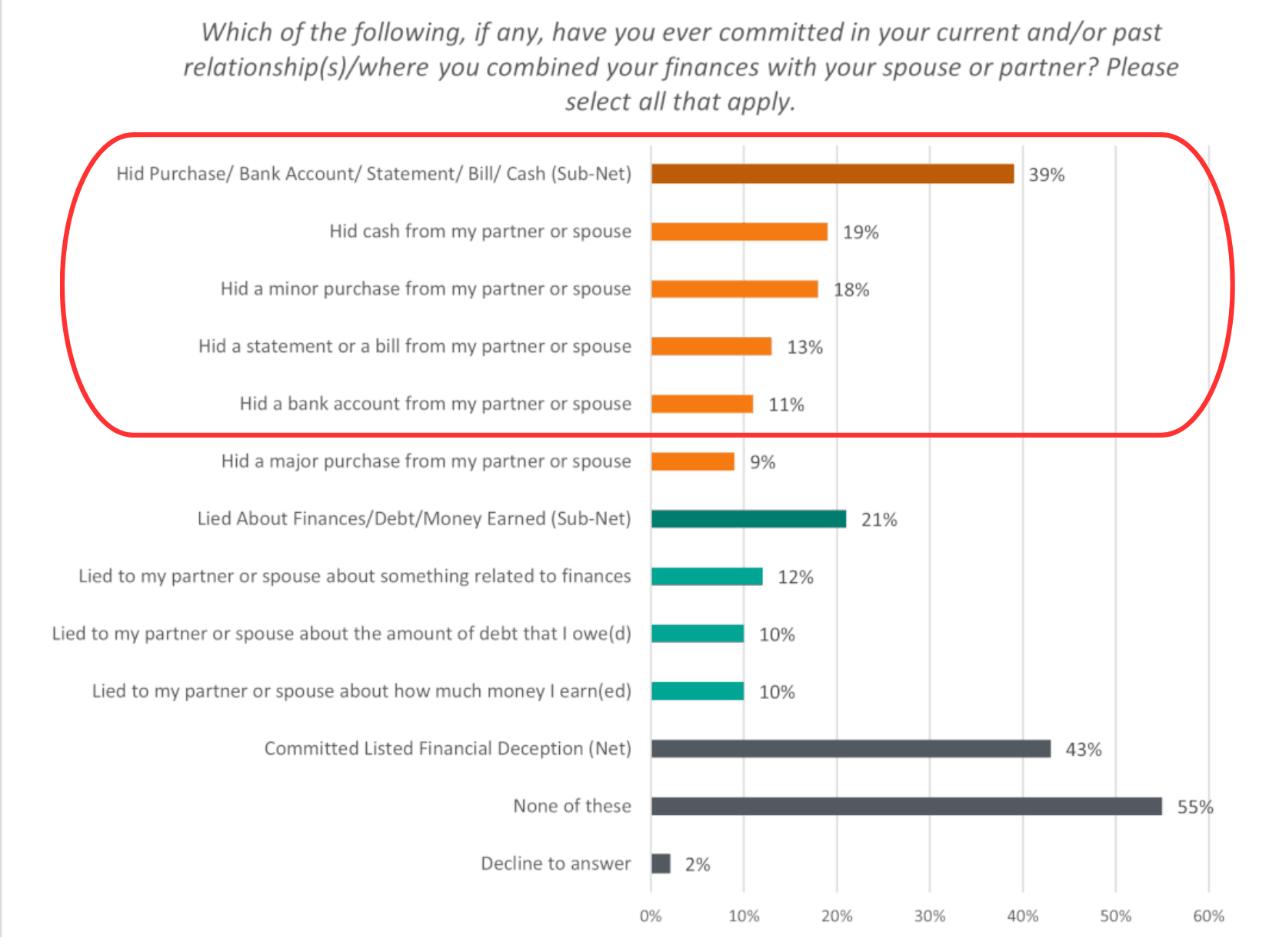

The National Endowment for Financial Education analyzed financial infidelity among adults who combined their finances in a relationship.

Two in five adults admitted they lied about money to their spouse or partner. Further, 85% of them stated that their deception affected relationship. We will cover it in later sections.

What Causes Financial Infidelity?

Indeed, a spouse committing financial adultery can use the above reasons to justify anything. On the other hand, they might not think about money seriously before saying “I DO,” promising transparency. In any case, you can lose your hard-earned cash.

The lesson?

BE CAREFUL!

Examples of Money Deceit in Marriage

You should know that financial infidelity can appear in many different ways.

It can be a minor offense like using an unknown credit card. Or it might be a more serious deception, like secretly siphoning both spouses' money and using family members for safekeeping.

Additionally, you might deal with anything in between and, in more severe situations, a combination of a few offenses.

Scary, right?

One of the most common examples of financial infidelity is hiding a bank statement from another spouse. You can see it three times among the top five offenses from The Harris Poll.

The 2021 Harris Poll on behalf of NEFE analyzing financial infidelity

Further, your spouse might have secret bank accounts or credit cards. Here, it is very likely that your spouse has paperless statements and does all transactions online.

The next common offense is hiding cash and big or small purchases, major and minor. For example, are you aware of unexplained expenses or extravagant splurges not aligning with your lifestyle?

Interestingly, current income level or homeownership status doesn't relate to financial deception. So, if you think that people with more money cheat more, it is not necessarily correct.

On the other hand, employed spouses (vs. unemployed) and households with kids under 18 are more likely to commit financial infidelity.

Another example of money deceit is when a person lies about how much money they earn, save, spend, and how they spend it. So, do you know exactly how much money your spouse makes? When last time did you see their paystubs?

But wait! There is more...

Financial deception can occur before marriage and the most serious example is when your partner lies about their income, assets, and debts in a prenuptial agreement, if there is one.

Signs of Financial Infidelity

So, you suspect financial infidelity. It's time to put on your detective hat and uncover the truth.

Let's discuss the top signs that can help you recognize financial deception and what to do about it.

If you are my client dealing with financial infidelity, I would ask you the following questions:

1. When was the last time you saw and reviewed the bank statements?

As I have shown, hiding a bank statement is one of the most common red flags of bad financial behavior. That's why you should review bank statements and dive into them keenly.

Specifically, look for any suspicious transactions or recurring payments that raise eyebrows.

2. How about your car insurance premium? Did it go up?

Most people don’t know that rates can go up not only because of the accident. There might also be other reasons:

- Your spouse might have credit cards you don’t know about.

- Your spouse doesn’t make those credit card payments on time.

3. Is your mail being delivered regularly?

If you still get your financial statements via mail, be careful if your mail stops being delivered. A common deception is when mail goes either to the office address or a family member.

A lot of people nowadays go paperless and handle their finances online. In this case, check periodically that your passwords are still working.

4. When did you and your spouse talk last time about money?

Most important that you both must engage in open and honest discussions about your financial situation. Ask questions, express your concerns, and pay attention to your spouse’s reactions.

Surprisingly, the truth reveals itself in the tides of conversation and speaks for itself.

Be Aware of Significant Unexplained Expenses

5. Do you have a lifestyle that doesn’t match your earnings?

It can be a situation with two extremes.

First is when your spouse is a highly paid employee. Do you have a nice lifestyle, or does your partner insist you be frugal?

Yes, it is reasonable to plan and have common sense no matter how much money you have. But it is suspicious when your partner insists on total control of all your money decisions.

On the other hand, what if your family lives beyond your means? Or does your partner have unexplained purchases or unusual spending habits?

In both cases, there is potential financial deception.

6. Are you aware of all the debts you and your spouse have?

Using a credit card by one spouse when the other partner knows nothing about it is another common sign of financial misbehavior. As a result, you can quickly end up in more debt.

What to do?

Check your credit report!

Just as a lighthouse guides ships to safety, a credit report can illuminate any hidden debts or accounts in your spouse's name. Request a copy and look for any unfamiliar charges or discrepancies.

Go to www.AnnualCreditReport.com and get your free credit report from all three reporting agencies.

Of course, the above red flags are just the alerts, and there might be more to the story...

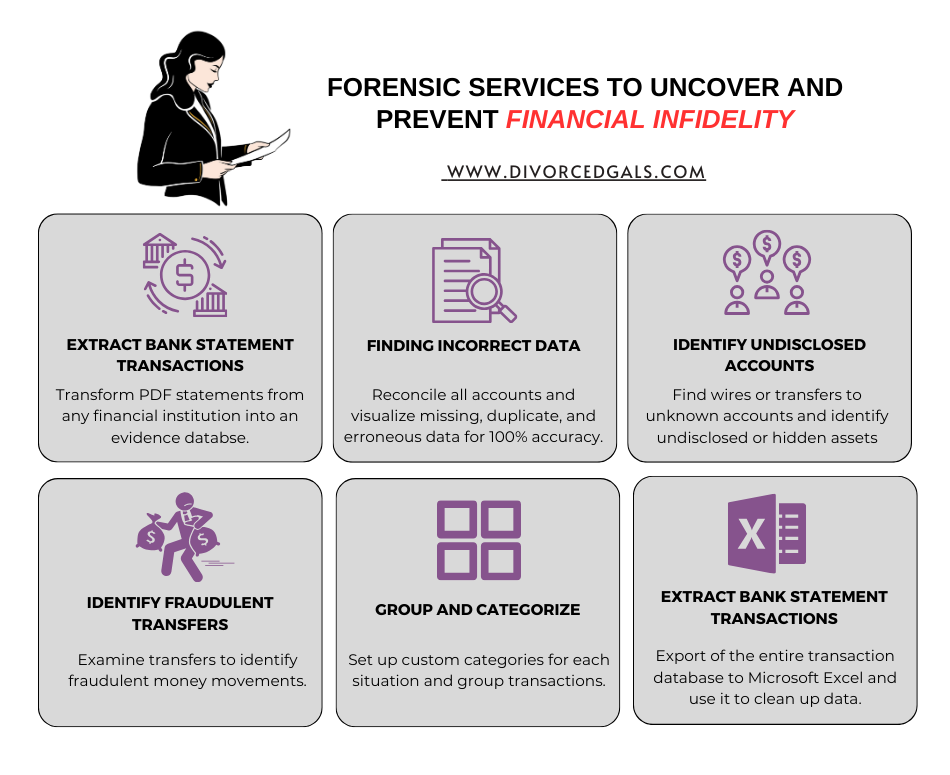

Check our services to help you identify and how to recover from financial infidelity.

Financial Infidelity and The Law

You may wonder if you can take legal action against your partner for their financial deception.

Can You Sue Your Spouse for Financial Infidelity?

While I am not a lawyer, it's like trying to sue the tooth fairy for not leaving enough cash under your pillow. The tooth fairy operates in a different realm, just like financial adultery often falls outside legal recourse.

Also, it is reasonable to ask:

Of course, every case is different, and seeking legal advice is essential to understanding your options and protecting your interests. You also have more legal options for holding a spouse accountable for financial infidelity in divorce.

Is Financial Infidelity Abuse?

In some instances, it can be a form of domestic abuse. WomensLaw.org suggests the following questions about how you are being treated. Specifically, does your partner:

- Steal money from you or your family?

- Force you to give them access to your bank accounts?

- Put you on an "allowance"?

- Force you to account for all the money you spend?

- Overuse your credit cards?

If the answer to some of those questions is "yes," your spouse is probably abusing you.

Is Financial Infidelity a Reason for Divorce?

Maybe.

Sorry to say, but when dealing with divorce financial planning, I see over-and-over examples of money betrayal in marriage. What's worse is repeated financial infidelity that might destroy you financially.

Of course, it all depends on what's at stake and how big the problem is.

If you think about divorce, take our pre-divorce quiz and download a free pre-divorce checklist.

Pre-Divorce Checklist PDF: 7 Sure Steps for Better Divorce

How to Overcome Financial Infidelity

But what if you want to save your relationship?

Know that even though The Harris Poll shows more negative impact of financial deception, RECOVERY IS POSSIBLE!

Financial Infidelity Impact:

Stronger Relationship

- 19% - couple become closer and grow together

- 16% - have proactive communication

Let's discuss how to save your marriage after financial infidelity.

Should You Forgive Financial Infidelity?

First, remember: COMMUNICATION IS KEY!

Sit down, grab a cup of coffee, and have an honest conversation with your partner. Tell them how their betrayal made you feel, and work together to rebuild TRUST. It may be daunting at first, but don't worry--we have a plan.

Curious?

How CDFA® Can Help To Recover from Financial Infidelity

Second, rebuilding a relationship after financial infidelity in marriage is a new phase of your life. For this reason, you must be vigilant. Otherwise, your partner might misbehave again, creating a financial disaster for both of you.

Can you afford it?

That's why you need professional help, especially with complex finances. It is like having a financial therapist guide you through this uncharted territory:

- Creating a joint budget

- Monitoring expenses and debts

- Setting financial goals

- Managing cash flow

- Making financial decisions together

- Periodic review of all your financial documents

So, check www.InstituteDFA.com and connect with Nella Zelensky, a CDFA®, MAFF® (Certified Divorce Financial Analyst®, Master Analyst in Financial Forensics®).

In any case, YOU CANNOT EXPECT IF YOU DON'T INSPECT!

Hiring a CDFA® or MAFF® and doing a periodic financial audit is often a provision of some couples' post-nuptial agreements.

Final Thoughts...

Remember that financial infidelity is a high-risk event since it can disrupt your life and your relationship. That's why you should:

- understand reasons for money betrayal

- recognize signs of financial deceiption

- have a review of all your personal finances, income, spending habits, investments, and debts

- discuss with your partner and prepare a recovery plan

- monitor your money regularly

In the end, financial deception doesn't have to sink your marriage. If you work with your partner, it's like being the captains of your ship, navigating the vast ocean of financial bliss together.

But regardless of whether you stay married, go solo, or have a new relationship, GET INVOLVED!

And it is especially critical if you are a woman. Why?

Because till these days, women still try to stay away from money matters. That is an old stereotype, and that is WRONG!

Lastly, know that help is available. Our goal is not only to show you how recover from financial infidelity. We will guide you into a more confident and prosperous financial future.

Are you ready?

Discover Your Options During and After Financial Infidelity!

Looking out for you,

Nella Zelensky

About the Author, Nella Zelensky, CDFA®, MAFF®